Selected chapters from the RTL Group Directors’ Report can be found here in digital form.

The complete Annual Report 2019 can be found here as a PDF flip catalogue.

RTL Group uses various key performance indicators (KPIs) to control its businesses, including revenue, EBITDA, EBITA and adjusted EBITA, RTL Group Value Added (RVA), net debt, cash conversion and audience share in main target groups.

Some of the RTL Group’s key performance indicators are determined on the basis of so-called alternative performance measures which are not defined by IFRS. Management believe that they are relevant for measuring the performance of the Group’s operations, financial position and cash flows, and for making decisions. These KPIs also provide additional information for users of the financial statements regarding the management of the Group on a consistent basis over time and regularity of reporting.

For definitions and more details on these KPIs (Adjusted EBITA excepted), see note 3.to the consolidated financial statements in the Annual Report 2019.

As announced in the outlook of the Annual Report 2018 the RTL Group reverted back to guidance on EBITA in its outlook statement. The Group believes this provides a better operational KPI than continuing to use EBITDA. The Group notes that the analyst community continues to use EBITA – some on an exclusive basis – as the main KPI for the Group’s profitability. Reverting back to EBITA therefore aligns the Group’s guidance to the expectations of the investment community. In addition, the Group’s EBITDA is affected by the application of the IFRS 16 (Leases) from 2019 onwards. As a result, RTL Group also comments primarily on EBITA as the KPI for measuring profitability. For purposes of comparability both EBITDA and EBITA are reported on for the Group’s business segments in this Directors' report.

Further, in order to determine a sustainable operating result that could be repeated under normal economic circumstances and is not affected by special factors or structural distortions EBITA is adjusted for special items. These special items primarily include restructuring costs and streaming start-up losses.

RTL Group’s KPIs may not be comparable to similarly titled measures reported by other groups due to differences in the way these measures are calculated.

RTL Group estimates that the net TV advertising market decreased in 2019 in all markets where the Group is active, with the exception of Hungary and the Netherlands.

| Net TV advertising market growth rate 2019 (in per cent) | RTL Group audience share in main target group 2019 (in per cent) | RTL Group audience share in main target group 2018 (in per cent) | |

| Germany | (2.5) to (3.0)1 | 28.12 | 27.52 |

| France | (1.5)3 | 22.84 | 21.44 |

| The Netherlands | +0.5 1 | 29.85 | 30.65 |

| Belgium | (3.2)1 | 34.56 | 35.36 |

| Hungary | +5.11 | 27.57 | 28.67 |

| Croatia | (4.8)1 | 25.88 | 27.18 |

| Spain | (5.8)9 | 27.710 | 28.410 |

1 Industry and RTL Group estimates

2 Source: GfK. Target group: 14−59

3 Source: Groupe M6 estimate

4 Source: Médiamétrie. Target group: women under 50 responsible for purchases (free-to-air channels: M6, W9, 6ter and Gulli

for 2019)

5 Source: SKO. Target group: 25−54, 18−24h. Restated for a different audience measurement method, now excluding the screen use coming from devices such as hard disk DVD and video recorders

6 Source: Audimétrie. Target group: shoppers 18−54, 17−23h

7 Source: AGB Hungary. Target group: 18−49, prime time (including cable channels)

8 Source: AGB Nielsen Media Research. Target group: 18−49, prime time

9 Source: Infoadex

10 Source: TNS Sofres.Commercial target group: 25−59 (previously 16–54) | |||

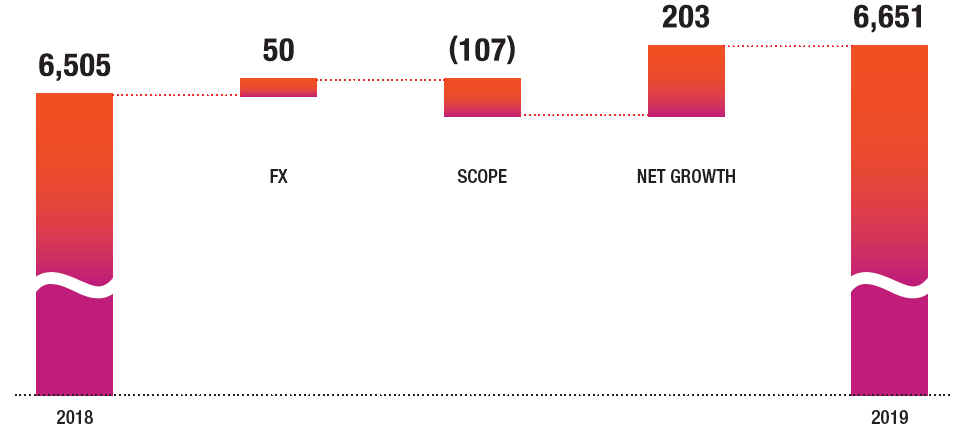

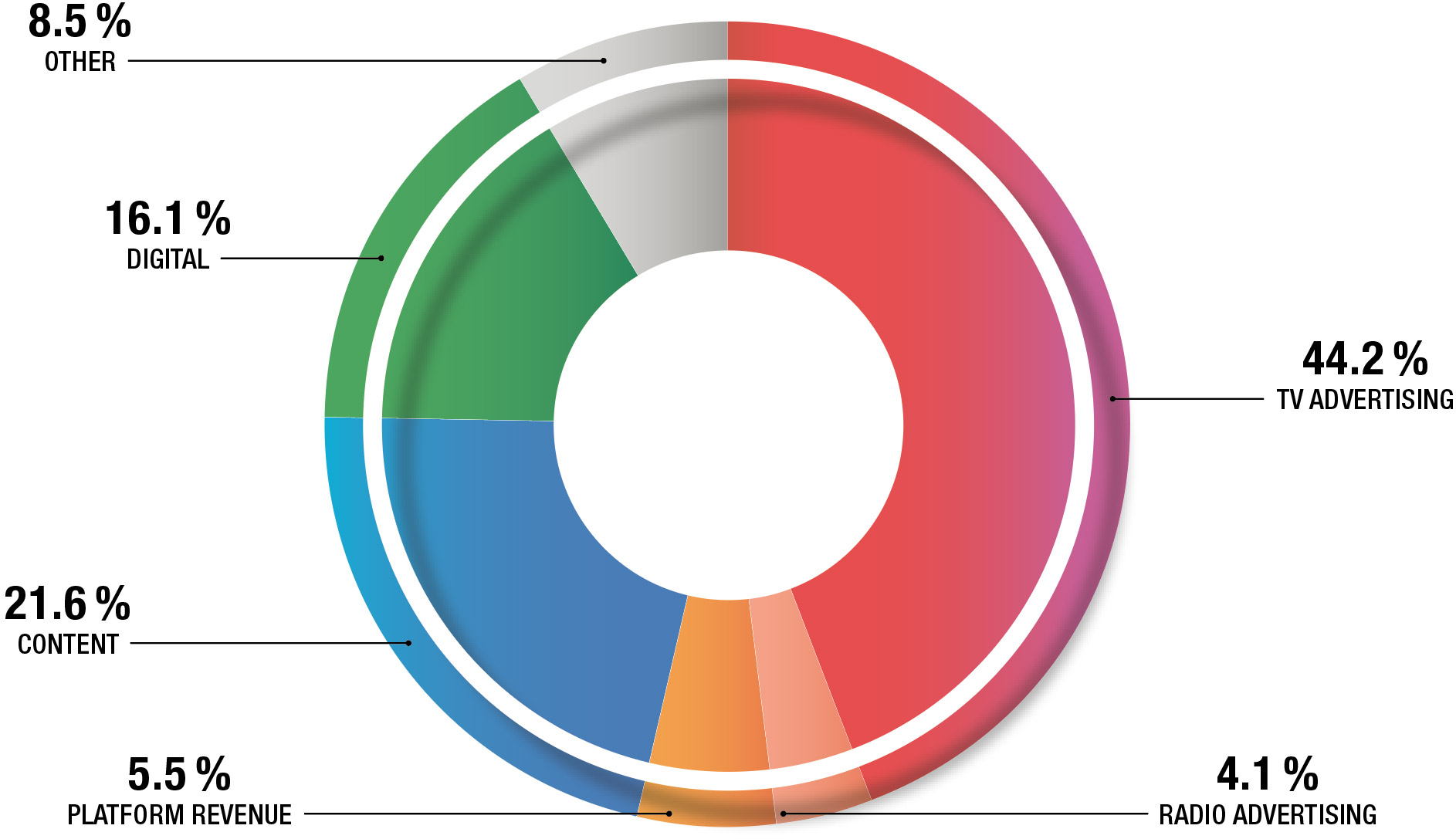

RTL Group’s total revenue was up 2.2 per cent to € 6,651 million (2018: € 6,505 million), reaching a record level. This was mainly driven by higher revenue from Fremantle and RTL Group’s digital businesses. Foreign exchange rate effects had a positive impact of € 50 million on reported revenue. On a like-for-like basis (adjusting for portfolio changes, the wind-down of StyleHaul and at constant exchange rates) revenue was up 3.2 per cent organically to € 6,518 million

(2018: € 6,317 million).

| 2019 €m | 2018 €m | Per cent change | |

| Total revenue | 6,651 | 6,505 | +2.2 |

| Broadcast1 | 4,625 | 4,693 | (1.4) |

| Content (Fremantle) | 1,793 | 1,592 | +12.6 |

| Digital activities (BBTV, Divimove & SpotX)2 | 452 | 412 | +9.7 |

| Eliminations | (219) | (192) | – |

1 Combined revenue of Mediengruppe RTL Deutschland, Groupe M6, RTL Nederland, RTL Belgium, RTL Hungary, RTL Croatia,

RTL Luxembourg

2 Combined revenue of RTL Group’s digital video networks (BroadbandTV, Divimove and StyleHaul, which was wound down in 2019) and those of SpotX (ad-tech) | |||

Streaming revenue1 from TV Now and Videoland was up by 46.7 per cent, to € 135 million (2018: € 92 million).

| 2019 € m | 2018 € m | ||||||

| Germany | 2,133 | 2,168 | |||||

| France | 1,439 | 1,460 | |||||

| USA | 1,118 | 972 | |||||

| The Netherlands | 527 | 549 | |||||

| UK | 295 | 245 | |||||

| Belgium | 215 | 211 | |||||

| Others | 924 | 900 | |||||

For more details on geographical information, see note 5.2.to the consolidated financial statements in the Annual Report 2019.

1 Streaming revenue includes SVOD, TVOD, and in-stream revenue from TV Now and Videoland

Reported EBITDA was € 1,405 million compared to € 1,380 million in 2018 (up 1.8 per cent), driven by the impact of the new IFRS 16 (Leases) standard and significantly higher contributions from Fremantle. The EBITDA margin was almost stable at 21.1 per cent (2018: 21.2 per cent).

In 2019, the Group’s EBITA was down 2.7 per cent to € 1,139 million for the year (2018: € 1,171 million), mainly due to higher costs in programming and streaming services. This resulted in an EBITA margin of 17.1 per cent (2017: 18.0 per cent). Adjusted for one-time effects related to restructuring of RTL Group’s Corporate Centre in Luxembourg (€ 17 million in 2019), EBITA was down only slightly, 1.3 per cent year on year.

For more detailed information and reconciliation of these measures see note 3.to the consolidated financial statements in the Annual Report 2019.

The performance indicator for assessing the profitability from operations and return on invested capital is RTL Group Value Added (RVA). RVA measures the profit realised above and beyond the expected return on invested capital. This form of value orientation is reflected in strategic investment and portfolio planning – including the management of Group operations.

The RVA is the difference between net operating profit after tax (NOPAT), defined as EBITA adjusted for a uniform tax rate of 33 per cent, and cost of capital.

The NOPAT corresponds to the sum of (i) EBITA of fully consolidated entities and share of result of investments accounted for using the equity method not already taxed, adjusted for a uniform tax rate of 33 per cent, and (ii) share of result of investments accounted for using the equity method already taxed.

Before 1 January 2019, the cost of capital is the product of the weighted average cost of capital (a uniform 8 per cent after tax) and the average invested capital (operating assets less non-interest-bearing operating liabilities). 66 per cent of the present value of operating leases and of satellite transponder service agreements (both net of related commitments received from investments accounted for using the equity method) is also taken into account when calculating the average invested capital.

From 1 January 2019 onwards, the cost of capital is the product of the weighted average cost of capital (a uniform 8 per cent after tax) and the quarterly average invested capital (operating assets, right-of-use assets included less non-interest-bearing operating liabilities, lease liabilities excluded).

In 2019, RVA was € 407 million (2018: € 442 million). For more detailed information on RVA, see note 3.to the consolidated financial statements in the Annual Report 2019.

The consolidated net debt at 31 December 2019 amounted to € 384 million (31 December 2018: net debt of € 470 million). The Group intends to maintain a conservative level of gearing of up to 1.0 times net debt to full-year EBITDA, in order to benefit from an efficient capital structure.

The Group continues to generate significant operating cash flow, with an EBITA to cash conversion ratio of 105 per cent in 2019 (2018: 90 per cent).

Net (debt)/cash position | As at 31 December 2019 € m | As at 31 December 2018 € m |

| Gross balance sheet debt | (788) | (894) |

| Add: cash and cash equivalents and other short-term investments | 405 | 424 |

| Add: cash deposit and others | - | - |

| Net (debt)/cash position1 | (384) | (470) |

| 1 Of which net debt of € 80 million held by Groupe M6 (net cash as at 31 December 2018: € 79 million). The net debt excludes current and non-current lease liabilities (€ 432 million at 31 December 2019). | ||

For more detailed information on net (debt)/cash position, see note 3.to the consolidated financial statements in the Annual Report 2019.

| 2019 € m | 2018 € m | 2017 € m | 2016 € m | 2015 € m | |

| Revenue | 6,651 | 6,505 | 6,373 | 6,237 | 6,029 |

| EBITDA | 1,405 | 1,380 | 1,464 | 1,411 | 1,360 |

| EBITA | 1,139 | 1,171 | 1,248 | 1,205 | 1,167 |

| RVA | 407 | 442 | 488 | 462 | 455 |

| Net (debt)/cash | (384) | (470) | (545) | (576) | (671) |

| Cash conversion (in per cent) | 105 | 90 | 104 | 97 | 87 |

Net cash from operating activities was € 1,085 million, representing an operating cash conversion rate of 105 per cent (2018: 88 per cent). Net debt was € 384 million at the end of 2019 (2018: € 470 million).

The profit for the period attributable to RTL Group shareholders was € 754 million (2018: € 668 million).

Group operating expenses were up 2.9 per cent to € 5,623 million (2018: € 5,464 million).

The share of results of investments accounted for using the equity method amounted to € 14 million (2018: € 56 million) reflecting an impairment of € 50 million against Atresmedia.

In 2019, the Group recorded a gain of € 86 million (2018: € 25 million).

Net interest expense amounted to € 32 million (2018: expense of € 20 million), primarily due to the interest charge on the Group’s financial debt, pension costs, lease liability and other interest expenses.

The Group has conducted an impairment testing on the different cash generating units (see note 8.2.to the consolidated financial statements in the Annual Report 2019).

The loss, totalling € 15 million, relates solely to the amortisation of fair values adjustments on acquisitions of subsidiaries (2018: € 120 million, including € 105 million of impairment of goodwill).

In 2019, the income tax expense was € 292 million (2018: expense of € 278 million). The income tax charge for 2018 included the recognition of a one-off deferred tax asset amounting to € 67 million and commission income, under the PLP Agreement (see note 10.1.to the consolidated financial statements in the RTL Group Annual Report 2019), of € 28 million. In 2019 the Group benefitted from commission income, under the PLP Agreement, of € 37 million.

The profit for the period attributable to RTL Group shareholders was € 754 million (2018: € 668 million).

Reported earnings per share, based upon 153,557,430 shares, both basic and diluted, was up 12.9 per cent to € 4.91 (2018: € 4.35 per share based on 153,548,938 shares).

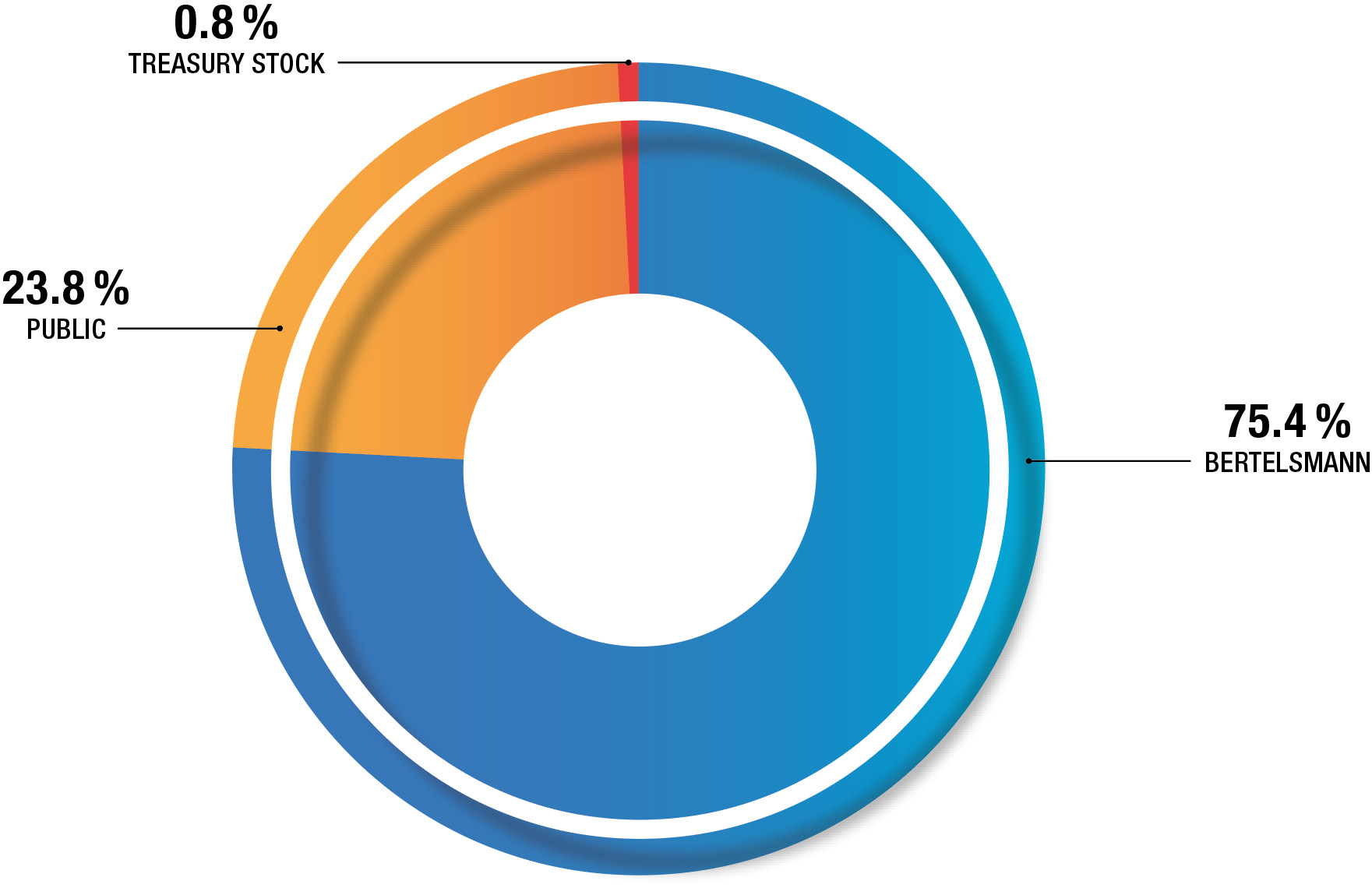

RTL Group has an issued share capital of € 191,845,074 divided into 154,742,806 fully paid up shares with no defined par value.

RTL Group directly and indirectly holds 0.8 per cent (2018: 0.8 per cent) of RTL Group’s shares (without taking into account the liquidity programme).

The annual accounts of RTL Group show a profit for the financial year 2019 of € 374,073,350 (2018: € 496,254,473). Taking into account the share premium account of € 4,691,802,190 (2018: € 4,691,802,190) and the profit brought forward of € 326,956,364 (2018: € 446,023,311), the amount available for distribution is € 5,392,831,904 (2018: € 5,479,524,455).

1 Amounts in Euro except where stated

On 1 February 2019, SpotX Limited acquired 100 per cent of the share capital of Yospace Enterprises Limited and its fully owned subsidiary, Yospace Technologies Limited (Yospace). Yospace is a UK-based video technology company. It has developed solutions for server-side dynamic ad insertion (SSDAI) which enables the replacement of existing commercials with more targeted commercials. This acquisition complements the ad-tech stack of RTL Group. The purchase consideration amounted to € 19 million, net of cash acquired.

On 30 April 2019, following the approval by the German competition authority, Mediengruppe RTL Deutschland has fully disposed of its interests held in Universum Film GmbH (Universum), a home entertainment and theatrical distribution company. The sale proceeds of € 91 million has generated a capital gain, net of transaction-related costs, of € 63 million.

On 2 September 2019, Groupe M6 acquired 100 per cent of the share capital of Jeunesse TV SAS, Lagardère Thématiques SAS (renamed Jeunesse Thématiques SAS) and LTI Vostock LLC. This acquisition, including the children’s channel Gulli, is a strategic opportunity for Groupe M6 to complement its offering for families and to strengthen its overall position in the French market, in particular by leveraging the power of the Gulli brand. The transaction qualifies as a business combination since Groupe M6 gained the control of the three companies. The purchase consideration amounted to € 215 million, net of cash acquired.

For more information on RTL Group’s main acquisitions and disposals and increase in interests held in subsidiaries please see note 6.2.to the consolidated financial statements in the RTL Group Annual Report 2019.

At 31 December 2019, the principal shareholder of the Group is Bertelsmann Capital Holding GmbH (BCH) (75.4 per cent). The remainder of the Group’s shares are publicly listed on the Frankfurt and Luxembourg Stock Exchanges. The ultimate parent company of RTL Group SA is Bertelsmann SE & Co KGaA, includes in its consolidated financial statements those of RTL Group SA.

The Group also has a related party relationship with its associates, joint ventures and with its directors and executive officers.

Launched in 2017 by Mediengruppe RTL Deutschland and Gruner + Jahr Electronic Media Sales (G+J), Ad Alliance GmbH (Ad Alliance) promotes cross-media advertising solutions based on a large portfolio of TV, magazines and digital brands, ensuring a high-reach presence to its customers. Ad Alliance operates as a sales agent and generates revenue from commissions on an arm´s length basis. On 1 January 2019, Ad Alliance started to market TV advertising, online and print advertising for thirds, RTL Group and G+J, Spiegel and, until April 2019, Ligatus.The increase of sales of goods and services and accounts payable of € 59 million and € 31 million is mainly due to the development of the Ad Alliance business in 2019 (commissions on advertising sales of € 32 million and related accounts payable € 28 million).

During the fourth quarter of 2019, RTL Nederland also launched a similar project in the Netherlands.

RTL Group is also part of Bertelsmann’s Content Alliance. This was launched in 2019 along with other Bertelsmann divisions (BMG, Gruner + Jahr and Random House) in order to develop creative content and use the talent within the Group across the various media platforms.

The comprehensive description on the related party transactions is disclosed in the note 10.1.to the consolidated financial statements in the RTL Group Annual Report 2019.

RTL Group’s shares (ISIN: LU0061462528) are publicly traded on the regulated market (Prime Standard) of the Frankfurt Stock Exchange and also on the Luxembourg stock exchange. Since September 2013, RTL Group has been listed in the MDAX stock index.

RTL Group’s share price started the year 2019 at just over € 46.70 and finished the year down 5.8 per cent, at € 43.98. The share price highs and lows were € 52.90 (19 March) and € 40.86 (15 August).

On a quarterly basis, the average share price evolved as follows:

Q1: € 48.46

Q2: € 46.81

Q3: € 44.27

Q4: € 43.72

The Group declared and paid a dividend in April. The April payment of € 3.00 (gross) per share related to the 2018 full-year ordinary dividend. The total cash paid out in 2019 with respect to RTL Group’s dividends amounted to € 461 million. Based on the average share price in 2019 (€ 45.80), the total dividends declared for the fiscal year 2019 (€ 4.00 per share; 2018: € 4.00 per share) represent a dividend yield of 8.7 per cent (2018: 6.3 per cent) and a payment of 81 per cent of the reported EPS (€ 4.91). Please see update on page 34.

For more information on the analysts’ views on RTL Group and RTL Group’s equity story, please visit the Investor Relations section on RTLGroup.com.

RTL Group decided, during 2019, to cancel its ratings from both S&P and Moody’s. These were, until the date of the cancellation, fully aligned to its parent company, Bertelsmann SE & Co. KG, due to its shareholding level and control on RTL Group.

In August 2019, RTL Group’s Board of Directors approved a new dividend policy, offering a pay-out ratio of at least 80 per cent of the Group’s adjusted net result.

The adjusted net result is the reported net result available to RTL Group shareholders, adjusted for significant one-off items (both positive and negative).

For more information on RTL Group’s shareholder return, please visit the Investor Relations section on RTLGroup.com.

The share capital of the company is set at € 191,845,074, divided into 154,742,806 shares with no par value.

The shares are in the form of either registered or bearer shares, at the option of the owner.

Bertelsmann has been the majority shareholder of RTL Group since July 2001. As at December 2019, Bertelsmann held 75.4 per cent of RTL Group shares, and 23.8 per cent were free float. The remaining 0.8 per cent were held collectively as treasury stock by RTL Group and one of its subsidiaries.

There is no obligation for a shareholder to inform the company of any transfer of bearer shares save for the obligations provided by the Luxembourg law of 15 January 2008 on transparency requirements in relation to information about issuers whose securities are admitted to trading on a regulated market. Accordingly, the Company shall not be liable for the accuracy or completeness of the information shown.

| ISIN | LU0061462528 |

| Exchange symbol | RRTL |

| WKN | 861149 |

| Share type | Ordinary |

| Bloomberg code | RRTL:GR |

| Reuters code | RRTL |

| Ticker | RRTL |

| Transparency level on first quotation | Prime standard |

| Market segment | Regulated market |

| Trading model | Continuous trading |

| Sector | Media |

| Stock exchanges | Frankfurt, Luxembourg |

| Last total dividend | €3.00 |

| Number of shares | 154,742,806 |

| Market capitalisation1 | €6,805,588,608 |

| 52 week high | €52.90 (19 March 2019) |

| 52 week low | €40.86 (15 August 2019) |

| 1 As of 31 December 2019 |

RTL Group’s shares are listed in the indices with the weight as outlined below:

| Index | Weight in per cent |

| MDAX | 1.2145 |

| MDAX Kursindex | 1.2145 |

| Prime All Share | 0.1745 |

| HDAX | 0.2007 |

The following sections give a digital overview about RTL Group’s reporting segments in 2019. Mediengruppe RTL Deutschland (including RTL Radio Deutschland and Smartclip), Groupe M6 (including the French RTL family of radio stations), Fremantle, RTL Nederland, RTL Belgium and Others which includes RTL Hungary, RTL Croatia, RTL Group’s Luxembourgish activities including the Group’s Corporate Centre and the investment accounted for using the equity method, Atresmedia in Spain). The segment Others also includes the digital businesses SpotX, BroadbandTV and Divimove.

| Revenue | 2019 €m | 20181 €m | Per cent change |

| Mediengruppe RTL Deutschland | 2,262 | 2,304 | (1.8) |

| Groupe M6 | 1,456 | 1,483 | (1.8) |

| Fremantle | 1,793 | 1,592 | +12.6 |

| RTL Nederland | 496 | 504 | (1.6) |

| RTL Belgium | 185 | 186 | (0.5) |

| Other segments | 724 | 670 | +8.1 |

| Eliminations | (265) | (234) | – |

| Total revenue | 6,651 | 6,505 | +2.2 |

EBITDA | 2019 €m | 20181 €m | Per cent change |

| Mediengruppe RTL Deutschland | 701 | 739 | (5.1) |

| Groupe M6 | 396 | 400 | (1.0) |

| Fremantle | 184 | 147 | +25.2 |

| RTL Nederland | 86 | 91 | (5.5) |

| RTL Belgium | 45 | 41 | +9.8 |

| Other segments | (7) | (38) | – |

| Reported EBITDA | 1,405 | 1,380 | +1.8 |

EBITA | 2019 €m | 20181 €m | Per cent change |

| Mediengruppe RTL Deutschland | 663 | 723 | (8.3) |

| Groupe M6 | 287 | 275 | +4.4 |

| Fremantle | 142 | 127 | +11.8 |

| RTL Nederland | 54 | 71 | (23.9) |

| RTL Belgium | 36 | 37 | (2.7) |

| Other segments | (43) | (62) | |

| EBITA | 1,139 | 1,171 | (2.7) |

EBITA margins | 2019 per cent | 20181 per cent | Percentage point change |

| Mediengruppe RTL Deutschland | 29.3 | 31.4 | (2.1) |

| Groupe M6 | 19.7 | 18.5 | +1.2 |

| Fremantle | 7.9 | 8.0 | (0.1) |

| RTL Nederland | 10.9 | 14.1 | (3.2) |

| RTL Belgium | 19.5 | 19.9 | (0.4) |

| RTL Group | 17.1 | 18.0 | (0.9) |

| 1 Since 2019, the management of the German radios and RTL Group’s European ad-tech businesses (except UK) report to Mediengruppe RTL Deutschland. These business units previously included in RTL Nederland and “Other segments” have been transferred to Mediengruppe RTL Deutschland segment. 2018 segment information has been restated accordingly | |||

In the reporting period the German net TV advertising market was estimated to be down between 2.5 and 3.0 per cent, with Mediengruppe RTL Deutschland outperforming the market, driven by the strength of its cross-media sales house Ad Alliance and audience performance. Mediengruppe RTL Deutschland’s revenue slightly decreased by 1.8 per cent to € 2,262 million (2018: € 2,304 million), with higher streaming and platform revenue largely compensating for lower TV advertising revenue and the scope exit of Universum Film. EBITA was down from € 723 million in 2018 to € 663 million – a decrease of 8.3 per cent reflecting higher programming costs (mainly sports rights such as for the ten matches of the German national football team aired in the reporting period) and TV Now. The results now include RTL Radio Deutschland and Smartclip, following their transfer from Other segments to Mediengruppe RTL Deutschland.

In 2019, the combined average audience share of Mediengruppe RTL Deutschland in the target group of viewers aged 14 to 59 increased to 28.1 per cent1 (2018: 27.5 per cent) – mainly due to the main channel RTL Television. The German RTL family of channels increased its lead over its main commercial competitor, ProSiebenSat1, to 3.1 percentage points (25.0 per cent, 2018: lead of 2.7 percentage points).

With an audience share of 10.7 per cent in the target group of viewers aged 14 to 59 in 2019 (2018: 10.4 per cent), RTL Television increased its audience share for the first time since 2011. For the 27th consecutive year, RTL Television was again the leading channel in the target group, well ahead of ZDF (8.0 per cent), ARD (7.8 per cent), Sat1 (7.6 per cent), and ProSieben (7.1 per cent). In addition, RTL Television was again the only channel with a double-digit audience share in this demographic. RTL Television's most-watched programme in 2019 was the Germany versus the Netherlands football game on 24 March 2019 which attracted a peak audience of 13.4 million viewers. 2019’s most successful show was Ich bin ein Star –Holt mich hier raus! (I’m a Celebrity, Get Me Out of Here!). On average, 5.38 million viewers (24.2 per cent) aged 3 and over watched the 13th season of the jungle challenge. The show's average audience share among viewers aged 14 to 59 was 32.0 per cent.

The revamped streaming service TV Now attracted 5.32 million unique users2 in September 2019, a record number and recorded an increase in paying subscribers of 45 per cent compared to 31 December 2019, as well as an increase in viewing time of 31 per cent. This was thanks to the wide range of programmes including the gay dating show Prince Charming, already recommissioned for a second season and the drama series M – Eine Stadt sucht einen Mörder.

Vox achieved a 6.4 per cent audience share in the target group of viewers aged 14 to 59 (2019: 6.3 per cent). A highlight show for Vox in 2019 was again Die Höhle der Löwen (Dragons’ Den), which generated an average audience share of 14.3 per cent among viewers aged 14 to 59. In addition, the show was the prime-time winner within the 14 to 54 target group with all eleven episodes. Sing meinen Song – Das Tauschkonzert also wowed viewers again, with the sixth season watched by 9.2 per cent of viewers aged 14 to 59, 1.3 percentage points up on the previous year.

In the 14 to 59 target group Nitro’s audience share in 2019 was 2.2 per cent (2018: 2.0 per cent). In its main target demographic of men aged 14 to 59, Nitro attracted an average audience share of 2.6 per cent (2018: 2.3 per cent).

The news channel NTV attracted 1.0 per cent of both the total audience and of viewers in the 14 to 59 demographic in 2019 (2018: 1.0 per cent).

RTL Plus continued its growth and attained a 1.6 per cent audience share in the 14 to 59 age group, up 0.2 percentage points on 2018.

Super RTL retained its leading position in the children’s segment in 2019, attracting an average audience share of 21.6 per cent in the target group of three to 13-year-olds between 06:00 and 20:15 (2018: 22.0 per cent), ahead of the public service broadcaster KiKA (17.7 per cent).

In 2019, RTL Zwei attained a market share of 4.2 per cent among 14 to 59-year-old viewers (2018: 4.4 per cent).

Radio consumption in Germany remained strong, reaching 76.5 per cent of Germans aged 14 and above every day. Commercial radio also increased its reach (up by 4.4 per cent in the same target group). RTL Group’s German radio portfolio increased its reach, thanks to Antenne Niedersachsen, Radio Hamburg and the Bavarian radio station Rock Antenne. 104.6 RTL maintained its market leading position in the highly competitive Berlin radio market in the target group of listeners aged 14 to 49 for the 25th consecutive year.

In March 2019, the audio platform Audio Now was launched. It includes the podcasts of all relevant German publishers and many Audio Now Originals, which are developed by the podcast production company Audio Alliance. By the end of the year, the Audio Alliance had already produced over 70 formats that together had been clicked over 7 million times on Audio Now.

1 Including pay-TV channels

2 According to the September 2019 edition of the German Association of Online Research's AGOF daily digital facts

In 2019, Groupe M6’s revenue was down by 1.8 per cent to € 1,456 million (2018: € 1,483 million). The decrease in revenue was mainly due to the sale of the soccer club Girondins de Bordeaux and MonAlbumPhoto in 2018, which was only partially compensated by higher TV ad sales following the acquisition of Lagardère’s TV operations in September 2019. With this acquisition – which included the country’s leading free-to-air channel for children, Gulli – Groupe M6 outperformed the French TV advertising market, which was estimated to be down 1.5 per cent year-on-year. Groupe M6’s EBITA was up 4.4 per cent to € 287 million (2018: € 275 million).

The net radio advertising market in France was estimated to be stable year on year, with Groupe M6’s radio family (RTL, RTL 2, Fun Radio) outperforming the market.

Groupe M6’s combined audience share was up to 22.8 per cent in the key commercial target group of women under 50 responsible for purchases (2018: 21.4 per cent), supported by the acquisition of Gulli1.

Flagship channel M6 retained its status as the second most-watched channel in France in the commercial target group, with an average audience share of 14.7 per cent (2018: 15.0 per cent). M6 entertainment brands such as L'Amour est dans le pré (The Farmer Wants a Wife), Top Chef or La France a Un Incroyable Talent (Got Talent) as well as M6’s successful news and magazine formats continued to record high audience shares.

W9’s audience share was 3.9 per cent among women under 50 responsible for purchases (2018: 3.8 per cent), ranking it second among the DTT channels in France. This was the result of programming combining high-audience reality series such as Les Marseillais VS Le reste du Monde, and powerful magazines such as Minute par minute.

6ter remained the leading HD DTT channel among the commercial target group for the fifth consecutive year, attracting an average audience share of 2.7 per cent (2018: 2.6 per cent). This was the channel’s best annual audience share since its launch in 2012.

With Gulli, Groupe M6 was the leader among the children’s target group (aged 4 to 10 years) during daytime (06:00 to 20:00) with an average audience share of 16.4 per cent (2018: 18.8 per cent). Thanks to its brands Bienvenue chez les Louds (Welcome to the Loud home) and Kally’s Mashup, Gulli was the favourite children TV channel in France for the ninth year.

In 2019, Groupe M6’s streaming offer 6play recorded 27 million registered users, up 10 per cent year on year (2018: 25 million registered users) and recorded 487 million hours watched (2018: 443 million hours). As a result, digital advertising revenue from the service was up strongly. With 12 original productions and 100 original brands online, 6play continues to be the ideal platform for Groupe M6 channels to innovate and test new programmes.

In 2019, the RTL radio family of stations registered a consolidated audience share of 18.4 per cent among listeners aged 13 and older in the latest measurement (2018: 19.5 per cent). Its flagship station, RTL Radio, was the leading station in France for the 17th consecutive year with an average audience share of 12.3 per cent in 2019 (2018: 12.9 per cent). The pop-rock station RTL 2 achieved an average audience share of 2.9 per cent in 2019 (2018: 2.9 per cent), while Fun Radio registered an average audience share of 3.4 per cent in 2019 (2018: 3.7 per cent).

2019 also witnessed Groupe M6’s first steps in the French podcast market, with the launch of the new brand RTL Originals, which registered 6 million downloads after its launch in May.

1 Free-to-air channels only, including Gulli on a full-year basis

Revenue of Fremantle – RTL Group’s content business – was up strongly, by 12.6 per cent to € 1,793 million in 2019 (2018: € 1,592 million). This increase was mainly driven by the delivery of new shows and series such as the second season of American Gods and America’s Got Talent: The Champions and by UFA in Germany. Fremantle’s drama revenue increased by 36.2 per cent to € 414 million (2018: € 304 million). Accordingly, EBITA increased by 11.8 per cent to € 142 million (2018: € 127 million).

In the US, America’s Got Talent: The Champions won an average audience of 12.4 million viewers resulting in a 12.3 per cent total audience share – performing 50 per cent higher than NBC’s prime-time average. The 14th season of America’s Got Talent, launched in May 2019, won an average audience share of 14.4 per cent among viewers aged 18 to 49, performing 56 per cent higher than NBC’s prime time average.

American Idol was ABC’s number one entertainment show of the 2018/19 season. For the key commercial target group of viewers aged 18 to 49 American Idol won a 7.0 per cent audience share, performing 25 per cent higher than ABC’s prime-time average. The third season on ABC has already been commissioned.

In 2019, The Greatest Dancer had a successful launch on BBC1 and was the UK’s highest rated new entertainment show of 2019, attracting young viewers and families. For the key commercial target group of viewers aged 16 to 34, The Greatest Dancer attracted an average audience share of 27.1 per cent. The show has been recommissioned for 2020.

The new format Game of Talents premiered in Spain on Cuatro in May 2019 and was the broadcaster’s highest-rated show in Monday prime-time in two years. It averaged over one million viewers across the series, performing 33 per cent higher than the broadcaster's prime-time average audience share.

Fremantle was also the partner of choice for many streaming platforms, producing local versions of Netflix’s Nailed It! for France, Germany and Spain.

The second season of American Gods was the highest-rated season launch on the US pay-TV channel Starz in over two years. The show was consistently the highest-rated broadcast on Starz throughout the season. The third season has been confirmed and is already in production.

The second season of the UFA drama production, Charité, attracted an average of 4.97 million total viewers, representing an average total audience share of 15.6 per cent. All six episodes of the second season were streamed 5.2 million times on the streaming service ARD Mediathek, making Charité the number one streamed TV series in Germany for 2019. UFA and ARD have already confirmed the third season of the historical hospital series.

Fremantle’s first drama from Norway, Exit, inspired by true stories of the super-rich, became NRK’s most streamed scripted series ever when it premiered in October 2019. The second season of The Rain from Miso Film premiered on Netflix in 2019 and has already been recommissioned for a third season.

Fremantle sold the remastered version of Baywatch to over 110 territories worldwide, including, among others, Amazon Prime Video (US, Australia, Canada, the UK and Ireland), Hulu (US), Bell Media (Canada), Viacom (Italy), and both Mediengruppe RTL Deutschland and NBC Universal (Germanspeaking Europe).

Fremantle entered into an exclusive deal with the leading Australian broadcaster SBS for a content mix including Dublin Murders, Baghdad Central, The Last Wave, The Attaché, Exit and Expedition.

In 2019, content produced by Fremantle attracted 391 million fans across YouTube, Facebook, Twitter and Instagram (2018: 340 million). During the year, Fremantle’s content had a total of 25 billion views on YouTube (2018: 26 billion) and 128 million subscribers across 337 channels (2018: 90 million subscribers across 332 channels).

The Dutch net TV advertising market was estimated to be slightly up by 0.5 per cent year on year. RTL Nederland’s revenue was down year on year to € 496 million (2018: € 504 million), mainly as a result of lower TV advertising revenue, partly compensated for by higher streaming and platform revenue. With lower TV advertising revenue and higher investments in the unit’s streaming service, Videoland, EBITA was down to € 54 million (2018: € 71 million).

In 2019, RTL Nederland's channels reached a combined prime-time audience share of 29.8 per cent in the target group of viewers aged 25 to 54 (2018: 30.6 per cent). RTL Nederland’s channels remained ahead of the public broadcasters (28.1 per cent) and Talpa TV (23.3 per cent).

RTL Nederland’s flagship channel, RTL 4, scored an average prime-time audience share of 17.2 per cent in the target group of shoppers aged 25 to 54 (2018: 17.7 per cent). RTL 4 retained its strong position in the talent show genre with The Voice Of Holland at the start of the year (38.5 per cent) and also at the start of a new season in autumn (39.4 per cent), as well as The Voice Kids (29.7 per cent), and the new shows The Masked Singer (32.3 per cent) and All Together Now (23.4 per cent).

RTL 5's prime-time audience share was 4.1 per cent in the target group of viewers aged 25 to 54 (2018: 4.2 per cent).

Men’s channel RTL 7 scored an average prime-time audience share of 5.5 per cent among male viewers aged 25 to 54 (2018: 5.9 per cent).

Women’s channel RTL 8 attracted an average prime-time audience share of 4.2 per cent among female viewers aged 35 to 59 (2018: 4.8 per cent).

RTL Z recorded a stable audience share of 1.0 per cent in the demographic of the upper social status aged 25 to 59 (2018: 1.0 per cent).

RTL Nederland’s streaming service, Videoland, recorded an increase in paying subscribers of 29 per cent and in viewing time of 45 per cent year on year. Videoland’s high growth was largely thanks to the reality format Temptation Island, the Dutch original series Judas, and the Emmy-winning US drama series The Handmaid’s Tale, all of which are exclusive to Videoland in the Netherlands.

Against the background of a declining net TV advertising market in French-speaking Belgium, estimated to be down 3.2 per cent year on year, RTL Belgium’s revenue was largely stable at € 185 million (2018: € 186 million). EBITA was down slightly, to € 36 million (2018: € 37 million).

RTL Belgium’s family of TV channels attracted a combined audience of 34.5 per cent among shoppers aged 18 to 54 (2018: 35.3 per cent), maintaining its position as the clear market leader in French-speaking Belgium. RTL Belgium increased its lead over the public channels to 14.9 percentage points (2018: 14.4 percentage points).

The flagship channel, RTL-TVI, had an audience share of 25.3 per cent among shoppers aged 18 to 54 (2018: 26.1 per cent) – 11.0 percentage points ahead of the Belgian public broadcaster La Une, and 13.7 percentage points ahead of the French broadcaster TF1. The most watched programme of the year on RTL-TVI was the movie RAID Dingue, which scored a total audience share of 51.1 per cent among shoppers aged 18 to 54. The magazines Face au Juge and Appel d’urgence registered average audience shares of 45.7 and 45.4 per cent respectively. Also popular was the evening news show, RTL Info 19h, with an average audience share of 39.2 per cent in the commercial target group.

Club RTL recorded an audience share of 6.8 per cent among male viewers aged 18 to 54 (2018: 6.9 per cent).

Plug RTL reported a prime-time audience share of 3.8 per cent among 15 to 34-year-old viewers (2018: 3.9 per cent).

According to the CIM audience surveys for 2019 (January to December), Bel RTL and Radio Contact achieved audience shares of 11.7 and 14.2 per cent respectively, among listeners aged 12 years and over. In 2018 (January to December), audience shares reached 13.6 and 13.9 per cent respectively.

RTL Belgium’s streaming service, RTL Play, performed strongly in 2019, with 820,000 registered users and 155,000 active users per month (2018: 445,000 registered users and 114,000 active users per month). Within the first full year of operation, RTL Play registered 12.5 million video views.

This segment mainly comprises RTL Group’s digital assets – both its global ad-tech company SpotX, and its investments in digital video networks : BroadbandTV, StyleHaul, which was wound down in 2019, and Divimove. It also includes the fully consolidated businesses RTL Hungary, RTL Croatia, RTL Group’s Luxembourgish activities (RTL Luxembourg, BCE and RTL Group’s Corporate Centre) and the investment accounted for using the equity method, Atresmedia in Spain.

| 2019 €m | 20181 €m | Per cent change | |

| Total revenue of other segments | 724 | 670 | +8.1 |

| Thereof | |||

| - Digital video networks | 319 | 331 | (3.6) |

| - Ad-tech | 133 | 82 | +62.2 |

| - RTL Hungary | 114 | 107 | +6.5 |

| - RTL Croatia | 47 | 46 | +2.2 |

| 1Since 2019, the management of the German radios and

RTL Group’s European ad-tech businesses (except UK) report to Mediengruppe RTL Deutschland. These business units previously included in RTL Nederland and “Other segments” have been transferred to Mediengruppe RTL Deutschland segment. 2018 segment information has been restated accordingly | |||

In 2019, the combined revenue of RTL Group’s digital video networks – including BroadbandTV, StyleHaul and Divimove – was down 3.6 per cent to € 319 million compared to € 331 million in 2018. The decrease was mainly due to the negative impact of the wind-down of StyleHaul, which was partly compensated for by the positive performance of BroadbandTV.

In 2019, BroadbandTV (BBTV) registered a total of 4291 billion video views – up 5.9 per cent from 2018 – while revenue increased 14.6 per cent year on year (in Canadian dollars: up 11.0 per cent). In 2019, BBTV secured partnerships with major digital content partners including the gaming channel Kwebbelkop, Jelly - a content owner with 12 million subscribers and over 200 million video views per month across his comic content – Family Fun Pack a family with six digital channels dedicated to children’s personalities and interests, the Grammy Award winner Flume and many more. The addition of these partners across a diverse range of content verticals further amplified BBTV’s depth of content and its ability to offer best-in-class service. In addition, BBTV announced a partnership with Snapchat, where BBTV content partners are given the opportunity to create eight to ten episodes of a first-person, personality driven show that airs directly on the Snapchat app. Shows began premiering in summer 2019.

In 2019, Divimove, a leading digital talent network and content studio in Europe, attracted a total of 34 billion video views (2018: 31 billion). The company registered 400 million subscribers per month – up 30 per cent on the same period in the previous year – across its 1,300 social influencers in Germany, Spain, the Netherlands, Italy, Poland, France and the Nordics, based on successful influencer management and acquisitions of top influencers in its core markets as well as the integration of UFA X (2018: 300 million subscribers across 900 social influencers). In January 2020, Divimove acquired Tube One Networks, a leading influencer marketing agency in Germany. The leading digital video company in the Nordics, United Screens, became part of Divimove during 2019. Revenue of Divimove (United Screens included) was up 6.6 per cent in 2019.

In August 2019, RTL Group decided on a strategic review of its ad-tech businesses. Mediengruppe RTL Deutschland took over the responsibility for the Group’s ad-tech business Smartclip. Furthermore, RTL Group sold its stake in Clypd in October 2019. RTL Group’s ad-tech revenue was up by 62.2 per cent to € 133 million compared to € 82 million in 2018. Combined EBITA was down to € 0.3 million (2018: € 5 million), mainly as a result of transaction costs related to the acquisition of Yospace.

As a leading video ad serving platform for premium publishers and broadcasters, SpotX continues to build solutions to help monetise video content across all screens and devices. The United States remains SpotX’s primary market, with over 70 per cent of its revenue now coming from major media owners and platforms, including AMC Networks, Discovery, Philo, Roku, and TiVo. SpotX currently reaches 42 million connected-TV households in the United States, with approximately 70 per cent of all ad spend in 2019 coming from over-the-top (OTT). SpotX completed its integration of Yospace2, a global leader in server-side dynamic ad insertion (SSDAI) for live OTT streaming.

The Hungarian net TV advertising market was estimated to be up by 5.1 per cent in 2019. Total consolidated revenue of RTL Hungary was up 6.5 per cent to € 114 million (2018: € 107 million) mainly due to higher TV advertising revenue. EBITA doubled to € 10 million (2018: € 5 million), also due to the abolishment of the advertising tax in Hungary in July 2019.

The combined prime-time audience share of the Hungarian RTL family of channels in the key demographic of 18 to 49-year-old viewers was 27.5 per cent (2018: 28.6 per cent). The prime-time audience share of RTL Klub increased to 14.4 per cent (2018: 14.3 per cent), and the channel remained the clear market leader, 3.8 percentage points ahead of its main commercial competitor TV2 (2018: 4.7 percentage points). The most popular programme was The X-Faktor, with an average audience share of 31.7 per cent in the target group. RTL Hungary’s cable channels achieved a combined prime-time audience share of 13.1 per cent among viewers aged 18 to 49 (2018: 14.3 per cent).

RTL Hungary’s online portfolio generated a total of 162 million video views of long and short-form content in 2019 (2018: 110 million) – 102 million of which were recorded on the streaming platform, RTL Most. In October 2019, RTL Hungary launched its premium platform RTL Most+ with additional exclusive content.

In Croatia, the net TV advertising market was estimated to be down 4.8 per cent. Nevertheless, RTL Croatia increased its revenue to € 47 million, driven by its digital businesses (2018: € 46 million). EBITA was € 1 million (2018: € 2 million).

RTL Croatia’s channels achieved a combined prime-time audience share of 25.8 per cent in the target audience aged 18 to 49 (2018: 27.1 per cent). The flagship channel, RTL Televizija, recorded a prime-time audience share of 17.6 per cent of 18 to 49-year-olds (2018: 17.9 per cent).

Local content, such as Ljubav je na selu (The Farmer Wants a Wife), Superpar (Powercouple) and Život na vagi (The Biggest Looser), remained a cornerstone of the channel’s programming. The year started with the Men’s Handball World Championship which attracted an average audience share of 34.5 per cent across 22 live matches, while the match between Spain and Croatia was watched by 60.4 per cent of 18 to 49-year-old viewers.

RTL 2 experienced a slight decrease in its prime-time audience share, to 5.6 per cent (2018: 6.8 per cent). The children’s channel, RTL Kockica, recorded an average audience share of 18.2 per cent (2018: 21.2 per cent) among children aged four to 14 between the hours of 7:00 and 20:00.

RTL Croatia’s online video views increased by 74.1 per cent to 54 million (2018: 31 million), including around 12 million video views from its streaming platform RTL Play (2018: 8 million), which was developed in collaboration with Groupe M6. RTL Play remained the leading streaming service in Croatia with 720,000 registered users, up by 80.0 per cent in 2019 (2018: 400,000).

In 2019, RTL Luxembourg confirmed its position as the leading media brand in the Grand Duchy of Luxembourg. Combining its TV, radio and digital activities (all three of which appear in the top five media ranking in Luxembourg), the RTL Luxembourg media family achieved a daily reach of 82.3 per cent (2018: 82.7 per cent) of all Luxembourgers aged 15 and over.

Remaining the number one station listeners turn to for news and entertainment, RTL Radio Lëtzebuerg reaches 164,500 listeners each weekday (2018: 184,900). RTL Télé Lëtzebuerg reached an important milestone with the co-production and launch of Luxembourg’s first crime series Capitani. Along with other shows, this allowed the TV channel to attract 124,700 viewers each day (2018: 129,800). RTL.lu, Luxembourg’s most visited website, has a daily reach of 45.8 per cent (2018: 41.6 per cent) of all Luxembourgers aged 15 and over.

In 2019, Broadcasting Center Europe (BCE) reinforced its position in the online video market through the acquisition of Freecaster, an online video platform serving broadcasters, sports federations, leading luxury brands and institutions. As a result, international institutions, such as the European Central Bank and the German Bundesrat now rely on BCE’s streaming services. BCE continued with the video transformation of the radio industry, the 4K/HD upgrade of key TV channels in EMEA, and the development of new cloud solutions for major video production companies.

The Spanish net TV advertising market decreased by an estimated 5.8 per cent in 2019. The Atresmedia family of channels achieved a combined audience share of 27.7 per cent in the commercial target group of viewers aged 25 to 59 (2018: 28.4 per cent). The main channel, Antena 3, recorded an audience share of 11.4 per cent (2018: 11.9 per cent) in the commercial target group.

On a 100 per cent basis, consolidated revenue of Atresmedia was slightly down 0.3 per cent to € 1,039 million (2018: € 1,042 million), while operating profit (EBITDA) was down by 1.6 per cent to € 184 million (2018: € 187 million) and net profit was € 118 million (2018: € 88 million). The profit share of RTL Group was up to € 22 million (2018: € 16 million).

The further reduction of the share price, the evolution of the Spanish TV advertising market, the decrease in consumption of linear TV, and the operating performance constituted triggering events for performing the impairment testing at 31 December 2019. The current valuation resulted in an impairment generating a loss of € 50 million at 31 December 2019.

For more information on investments in associates please see note 8.5.1.to the consolidated financial statements in the RTL Group Annual Report 2019.

1 Including views from external partners

2 Acquired in February 2019

RTL Group believes that CR adds value not only to the societies and communities it serves, but also to the Group and its businesses. Acting responsibly and sustainably enhances the Group’s ability to remain successful in the future.

CR is integral to the Group’s mission. The Mission Statement defines what the Group does, what it stands for and how employees communicate – both with the outside world and with each other. At the heart of RTL Group’s guiding principles and values is a commitment to embrace independence and diversity in its people, content and businesses.

Following the reorganisation of the Group’s Corporate Centre in 2019, RTL Group will redefine its CR organisation in the first half of 2020. As part of this reevaluation it has been decided to discontinue publishing the Group’s own Non-financial Statement. The information of the Combined Non-Financial Statement compliant with the European Directive 2014/95/EU and provisions by the law of 23 July 2016 regarding the publication of non-financial and diversity information in Luxembourg – can be found in the Annual Report of our majority shareholder Bertelsmann SE & Co KGaA. Further information on RTL Group’s non-financial information can also be found in the GRI reporting of Bertelsmann SE & Co KGaA on Bertelsmann.com.

The RTL Group CR Network, created several years ago and consisting of CR representatives from the Group’s profit centres, meets annually to serve as a best-practice and knowledge-sharing platform.

This summary non-financial document covers the key information of the following relevant subjects: editorial independence, employees, diversity, society, intellectual property and copyright, information security, data protection and privacy, anti-corruption and anti-bribery, human rights and environment.

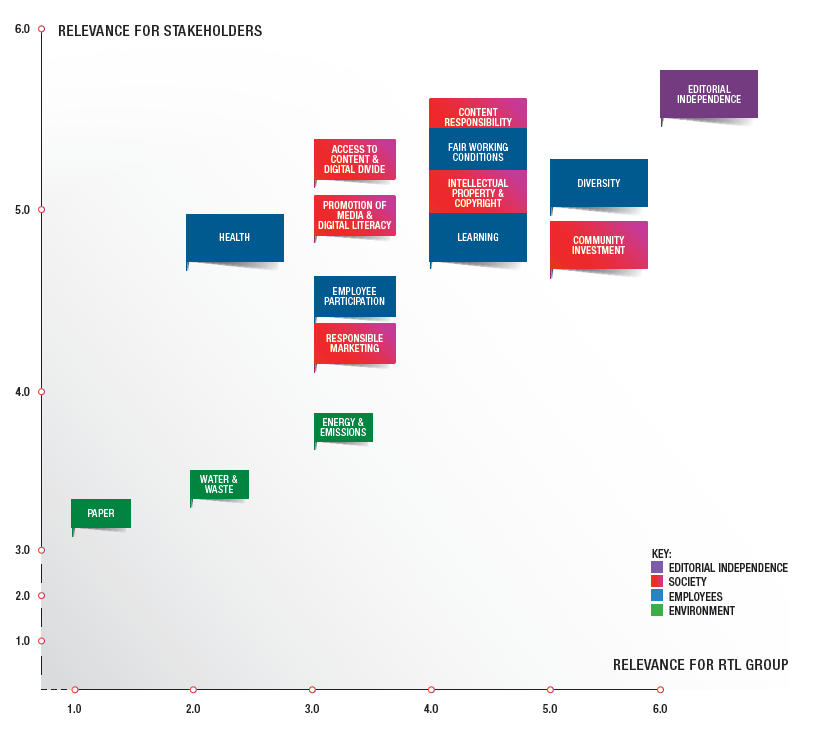

RTL Group’s CR activities focus primarily on the following issues: editorial independence, diversity, community investment, content responsibility, learning, and fair working conditions. These issues were identified in a materiality analysis conducted in 2017 in close consultation with Bertelsmann. Although the analysis did not deem environmental and climate protection to be among the most material issues for RTL Group, the Group is nevertheless strongly committed to this issue. In 2020, the current relevance analysis will be reviewed and updated in close collaboration with Bertelsmann.

RTL Group’s broadcasting and news reporting are founded on editorial and journalistic independence. RTL Group’s commitment to impartiality, responsibility and other core journalistic principles is articulated in its Newsroom Guidelines. Maintaining audience trust has become even more important in an era when news organisations and tech platforms have been accused of publishing misleading stories, and when individuals, radical political movements and even hostile powers post fake news on social networks to sow discord.

For RTL Group, independence means being able to provide news and information without compromising its journalistic principles and balanced position. Local CEOs act as publishers and thus are not involved in producing content. In each news organisation, editors-in-chief apply rigorous ethical standards and ensure compliance with local guidelines, which gives the Group’s journalists the freedom to express a range of opinions, reflecting society’s diversity and supporting democracy.

RTL Group has a diverse audience and therefore needs to be a diverse and creative business. In 2019, the Group had an average of 10,747 full-time employees (16,264 headcount, including permanent and temporary employees) in more than 30 countries worldwide. They range from producers and finance professionals to journalists and digital technology experts.

RTL Group strives to be an employer of choice, one that attracts and retains the best talent. The objective is to equip employees with the skills and attitudes they need to confidently address the company’s current and future challenges. The Group does this by offering training programmes and individual coaching in a wide range of subjects, from strategy and leadership to digital skills and health and well-being. It reviews and, if necessary, adjusts its training catalogue on an ongoing basis.

RTL Group’s corporate culture is founded on creativity and entrepreneurship. The Group strives to ensure that all employees receive fair recognition, treatment and opportunities and is committed to fair and gender-blind pay. The same applies to the remuneration of freelancers and temporary staff, ensuring that such employment relationships do not compromise or circumvent employee rights. The Group also strives to support flexible working arrangements.

RTL Group’s commitment to diversity is embedded in its processes and articulated in its corporate principles. The cornerstone is a Diversity Statement which unequivocally affirms the pledge to promote diversity and ensure equal opportunity throughout RTL Group. It sets guidelines and qualitative ambitions for the diversity of the Group’s people, content and businesses.

RTL Group is committed to making every level of the organisation more diverse with regard to nationality, gender, age, ethnicity, religion and socio-economic background. The Group places a special emphasis on gender diversity. Although RTL Group’s workforce as a whole is balanced by gender (with 52 per cent men and 48 per cent women at the end of 2019), in management positions men outnumber women by a wide margin. At the end of 2019, women accounted for 22 per cent of top management positions, and 20 per cent of senior management positions.1

RTL Group’s long-term ambition is for women and men to be represented equally across all management positions. In 2019, RTL Group’s Executive Committee reviewed the Group’s objectives and set the following quantitative targets for 2021: to increase the ratio of women in top and senior management positions to at least one third (21 per cent at the end of 2019). The Group reports on its progress towards these diversity targets each year.

The issue and importance of diversity is also reflected in the content the Group produces. The millions of people who turn to RTL Group each day for the latest local, national and international news need a source they can trust. RTL Group therefore maintains a journalistic balance that reflects the diverse opinions of the societies it serves. The same commitment to diversity applies to the Group’s entertainment programming: it is essential for RTL Group to create formats for a wide range of audiences across all platforms. Content needs to be as representative as possible of the diversity of society, so that many different segments of society can identify with it.

1 Top management generally encompasses the members of the Executive Committee, the CEOs of the business units and their direct Management Board members and the Executive Vice Presidents of RTL Group’s Corporate Centre. Senior management generally encompasses the Managing Directors of the businesses at each business unit, the heads of the business units’ departments and the Senior Vice Presidents of RTL Group’s Corporate Centre

RTL Group is a leading media organisation and broadcaster and, as such, has social responsibilities to the communities and audiences it serves. These responsibilities are particularly serious with regard to children and young people. The Group complies fully with all child-protection laws and also ensures that its programming is suitable for children or is broadcast when they are unlikely to be viewing. In addition, RTL Group strives to give back to its communities by using its high profile to raise public awareness of, and funds for, important social issues, particularly those that might otherwise receive less coverage or funding.

As part of the Group’s support of worthy causes, it provides free airtime worth several million euros to charities or non-profit organisations, to enable them to raise awareness of their cause. In addition, RTL Group donates significant amounts of money to numerous charitable initiatives and corporate foundations. Finally, RTL Group’s flagship events broadcast in 2019 (Télévie in Belgium and Luxembourg; RTL Spendenmarathon in Germany) raised € 24,806,880 for charity

(2018: € 23,064,207).

RTL Group’s primary mission is to invest in high-quality entertainment programmes, fiction, drama, news and sports, and to attract new creative talent who can help the Group contribute to a vibrant, creative, innovative and diverse media landscape. Strong intellectual property rights are the foundation of RTL Group’s business, and that of creators and rights holders.

RTL Group’s Code of Conduct and Information Security Policy set a high standard for the protection of intellectual property. All employees are expected to comply with copyright laws and licensing agreements and to put in place appropriate security practices (password protection, approved technology and licensed software) to protect intellectual property. Sharing, downloading or exchanging copyrighted files without appropriate permission is prohibited.

RTL Group collects, retains, uses and transmits the personal data of customers, employees and third parties with great care, and has developed a framework of policies and internal controls in order to adapt to, and comply with, applicable laws and regulations. Neglecting information security (IS) challenges would jeopardise RTL Group’s businesses. The risks include data loss, identity theft, unauthorised access or copyright infringement. These, in turn, could put the Group in breach of contract, harm its reputation, impede its operations or cause financial loss.

In 2014, RTL Group established a revised Group-wide framework of structured roles for the organisation and governance of IT and IS. RTL Group’s IT Governance Committee (ITGCo), is responsible for ensuring the Group adopts a thorough and structured approach to IT. The ITGCo is required by RTL Group’s Executive Committee to take decisions on all IT-related issues, including the design of Group-wide IT strategy, governance, IT and IS policies, and the definition and monitoring of Group-wide IT initiatives and projects.

As stated in the RTL Group IT Guidelines, each business unit has defined IT roles and responsibilities. These include Business Unit Information Security Officers, who are responsible for ensuring the implementation of IT policies and the continuous monitoring of cyber security risks, and License Compliance Managers, who oversee compliance with software licenses. In March 2018, RTL Group adopted a privacy and general data protection policy that defines the principles and organisational framework needed to comply with GDPR. This guidance enables the business units to ensure that their affiliated companies comply with the regulations.

RTL Group is aware that the foundation for lasting business success is built on integrity and trustworthiness, and has zero tolerance of any form of illegal or unethical conduct. Violating laws and regulations – including those relating to bribery and corruption – is not consistent with RTL Group’s values and could damage the Group. Non-compliance could harm the Group’s reputation, result in significant fines, endanger its business success and expose its people to criminal or civil prosecution.

The Compliance department provides Group-wide support on anti-corruption, anti-bribery, and other compliance-related matters. In addition to centralised management by the Compliance department, each business unit has a Compliance Responsible in charge of addressing compliance issues, including anti-corruption.

For information about RTL Group’s Audit Committee please see pages 79 to 80 of RTL Group’s Annual Report.

Representatives of RTL Group management sit on the RTL Group Corporate Compliance Committee. The committee, which is chaired by RTL Group’s Chief Financial Officer, is responsible for monitoring compliance activities, promoting ethical conduct and fighting corruption and bribery. It is kept informed about ongoing compliance cases and the measures taken to prevent compliance violations.

The RTL Group Anti-Corruption Policy is the Group’s principal policy for fighting corruption. It outlines rules and procedures for conducting business in accordance with anti-corruption laws and Group principles.

Respect for human rights is a vital part of RTL Group’s Code of Conduct, which includes a decision-making guide that clarifies how to comply with the company’s standards in case of doubt. The Group’s commitment to responsible and ethical business practices extends to its business partners. In 2017, RTL Group established the RTL Group Business Partner Principles, which sets minimum standards for responsible business relationships. To report suspected human rights violations or unethical practices, employees and third parties can contact RTL Group’s compliance reporting channels (directly or through a web-based reporting platform) or an independent ombudsperson. In all cases, they may do so anonymously.

RTL Group is a media company with no industrial operations and therefore does not consume significant amounts of raw materials or fossil fuel and is not a major polluter. The Group is mindful that resource conservation and climate protection are key challenges for the 21st century. For this reason – together with employees and in dialogue with various stakeholders – RTL Group is committed to minimising its impact on the environment, by reducing its energy use and its direct and indirect greenhouse gas (GHG) emissions. It codified this commitment in February 2018 by issuing its first Environmental Statement.

RTL Group has measured and published its carbon footprint since 2008. Serving as the key indicator for evaluating and continually improving the Group’s climate performance, it was formerly calculated on the basis of each country’s average energy mix. To improve data quality, since 2017 it has been calculated on the basis of the emissions associated with the Group’s individual electricity supply contracts.

At the beginning of 2020, RTL Group decided to become carbon neutral by 2030.

For RTL Group’s environmental indicators according to GRI standards please visit RTLGroup.com.